Irs Tax Brackets 2025 Calculator - Estimate your 2025 taxes with aarp's federal tax calculator. New Tax Brackets 2025 See How You're Affected for Social Security, Use our income tax calculator to estimate how much you'll owe in taxes. Irs announces 2025 tax brackets, updated standard deduction.

Estimate your 2025 taxes with aarp's federal tax calculator.

2025 Tax Brackets Calculator Nolie Frannie, You pay tax as a percentage of your income in layers called tax brackets. And is based on the tax brackets of.

Irs Tax Bracket Chart 2025 Ursa Tiffanie, Irs announces 2025 tax brackets, updated standard deduction. Enter your income and location to estimate your tax burden.

Irs Tax Brackets 2025 Vs 2025 Cheryl Thomasina, Estimate your 2025 taxes with aarp's federal tax calculator. And is based on the tax brackets of.

2025 tax brackets IRS inflation adjustments to boost paychecks, lower, Estimate your 2025 taxes with aarp's federal tax calculator. This tax return and refund estimator is for tax year 2025.

2025 Tax Brackets Single Calculator Mandy Lauretta, You pay tax as a percentage of your income in layers called tax brackets. Simply enter your taxable income and filing status to find your top tax rate.

For 2025, the seven federal income tax rates are 10%, 12%, 22%, 24%, 32%, 35% and 37%. The federal income tax has seven tax rates in 2025:

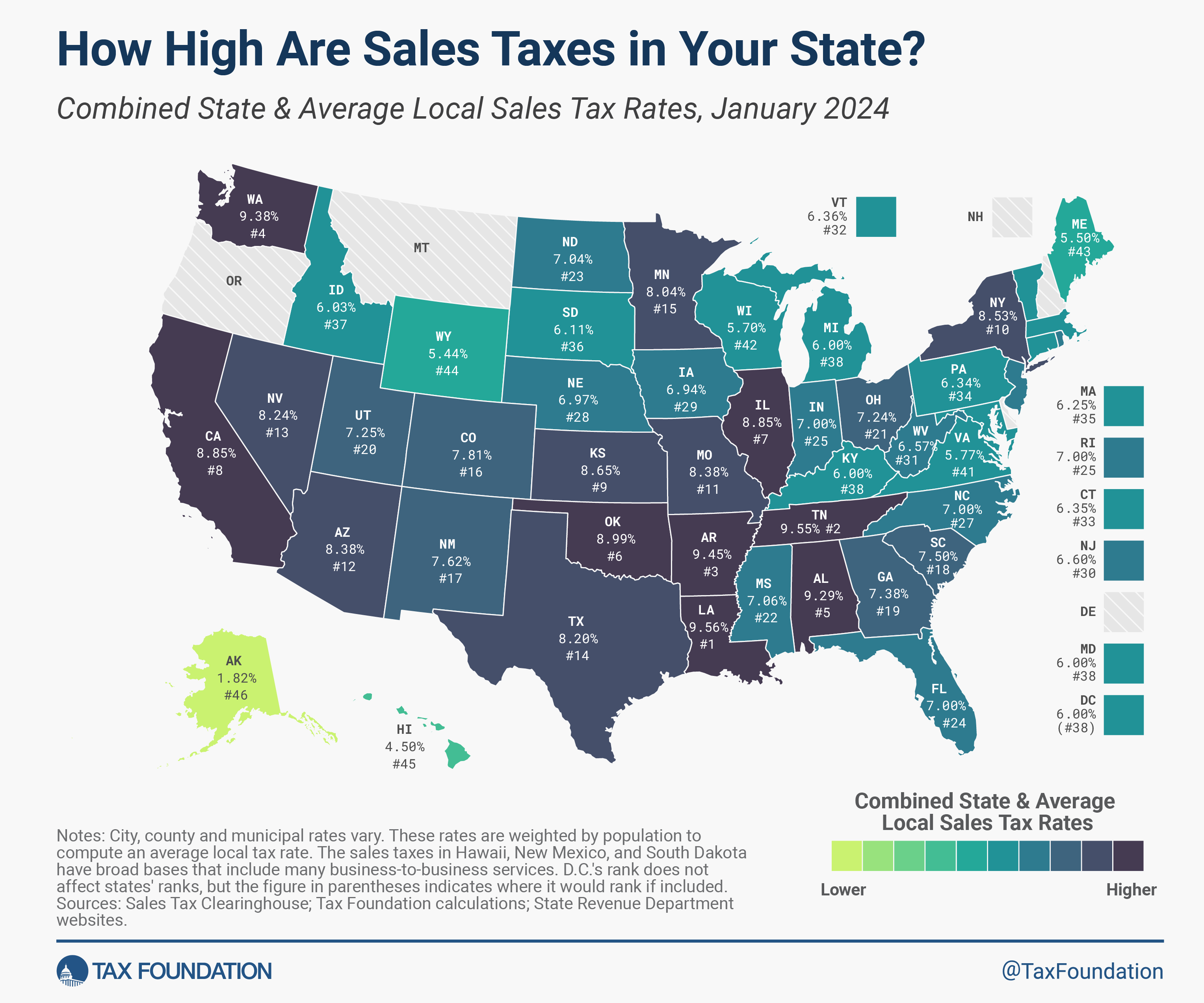

Irs Sales Tax Calculator 2025 Lee Karalee, The irs uses 7 brackets to calculate your tax bill based on your income and filing status. You can use our federal tax brackets calculator to determine how much tax you will pay for the current tax year, or to determine how much tax you have paid in previous tax.

Tax Brackets 2025 Vs 2025 Ny Norri Annmarie, Feel confident with our free tax calculator that's up to date on the latest tax laws. It is mainly intended for residents of the u.s.

Effective Tax Bracket Calculator 2025 Lira Valina, For single taxpayers and married individuals filing separately, the standard deduction rises to $14,600 for 2025, an increase of $750 from 2023; Federal and state tax calculator for 2025 annual tax calculations with full line by li.

For 2025, the seven federal income tax rates are 10%, 12%, 22%, 24%, 32%, 35% and 37%.